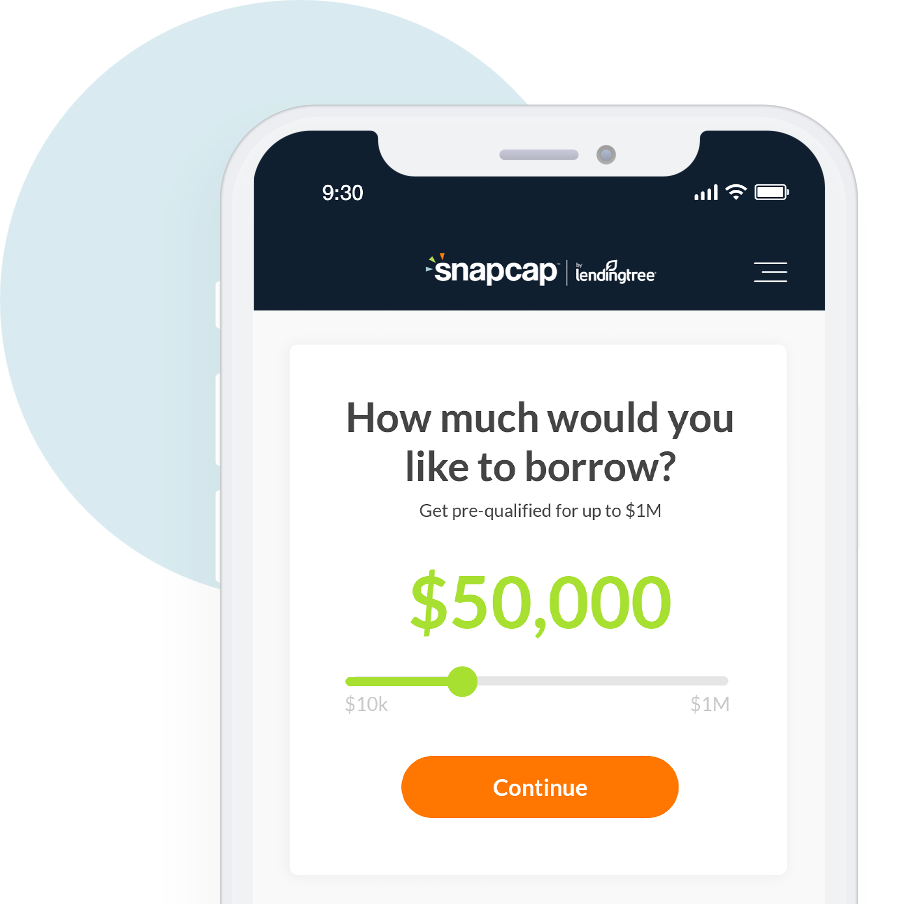

Business Loans

Get pre-qualified for up to $1M

What is an unsecured loan?

An unsecured loan, sometimes referred to as a signature loan or a merchant loan, is a special type of financing available to business that is different from traditional lending. Instead of requiring collateral to obtain financing, unsecured lending uses several other factors to judge the eligibility of a loan applicant. These could include things such as your credit score and sales records from the business. This type of financing may be advisable for small business owners who do not want to risk their personal collateral in order to obtain the financing they need. Since the loan requirements differ from traditional bank loans, the interest rates and speed of approval can be much different. Often times these merchant loans are reviewed and approved in a very short time frame, making them ideal for anyone who is in need of immediate capital.

Secured vs. Unsecured Loans

The main difference between an unsecured and a secured loan is the collateral required. Of course, that difference affects other things about the loan as well, including terms and interest rates.

Secured Loans

Secured Loans often come from banks or traditional lending sources. They are the most common type of financial borrowing available. Secured loans, backed by an asset such as a house or piece of property, give the lender the ability to repossess collateral should the borrower default on their loan. The type of collateral required can vary and the lender and borrower must come to agreeable terms in order to move forward with the lending process.

Loan processes vary between different secured lending services. The standard procedure usually involves the loan amount, asset negotiation and loan repayment terms. Repayment terms are often much more generous in both time and interest rate because the loan is backed by collateral in the event of default. Secured loans, backed by an asset such as a house or piece of property, give the lender the ability to repossess collateral should the borrower default on their loan.

Unsecured Loans

Unsecured loans are drastically different. They don’t involve collateral, have different application requirements, and sometimes don’t even involve a bank. Since merchant business lending is not centered on collateral or personal assets, the lender uses factors of your business to determine loan worthiness. Some factors that can help with acquiring an unsecured loan might include your credit history, sales records, business growth, and projected financial income.

Unsecured business loans can come in the form of credit cards, personal loans, corporate bonds, and merchant cash advance financing. Interest rates tend to be higher and come with a shorter repayment period, which results in a lower amount paid towards interest.

Why SnapCap?

SnapCap was created to challenge the way credit and loan decisions were made. Traditional lending isn’t the only game in town anymore. Thanks to technological innovations in the lending space, new private lenders have been able to make fast and accurate credit decisions faster — going from weeks to just hours. We specialize in connecting business owners to these lenders, helping them find funding solutions that fit their unique businesses.