How It Works

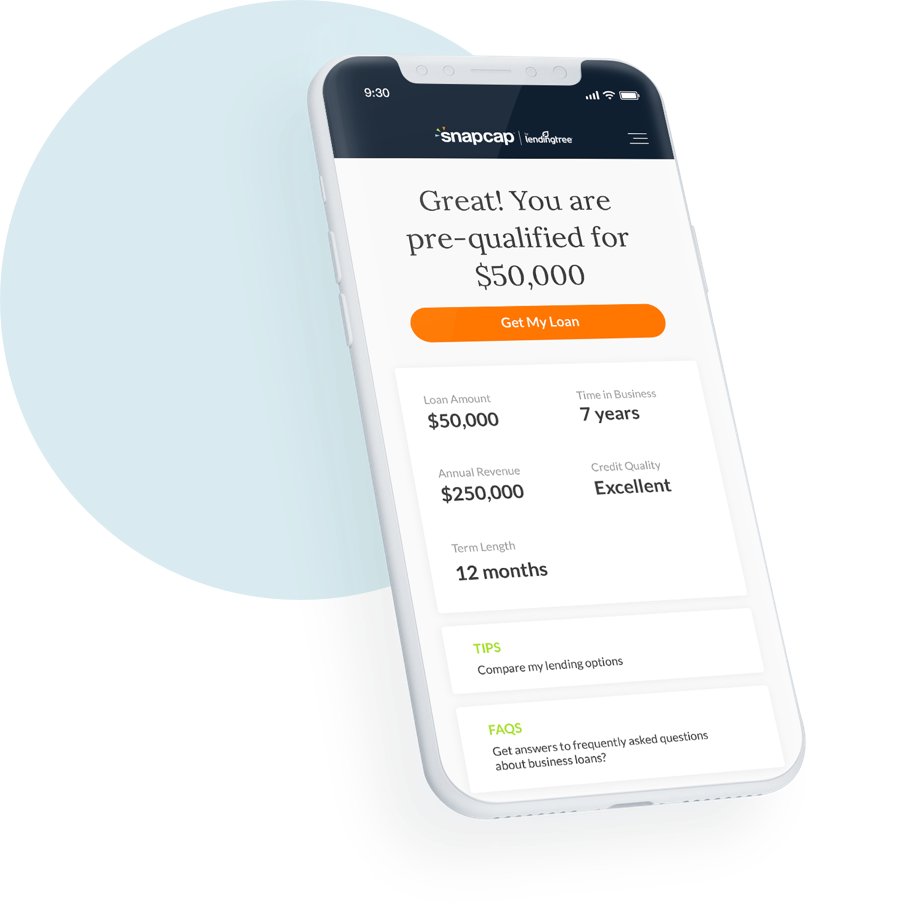

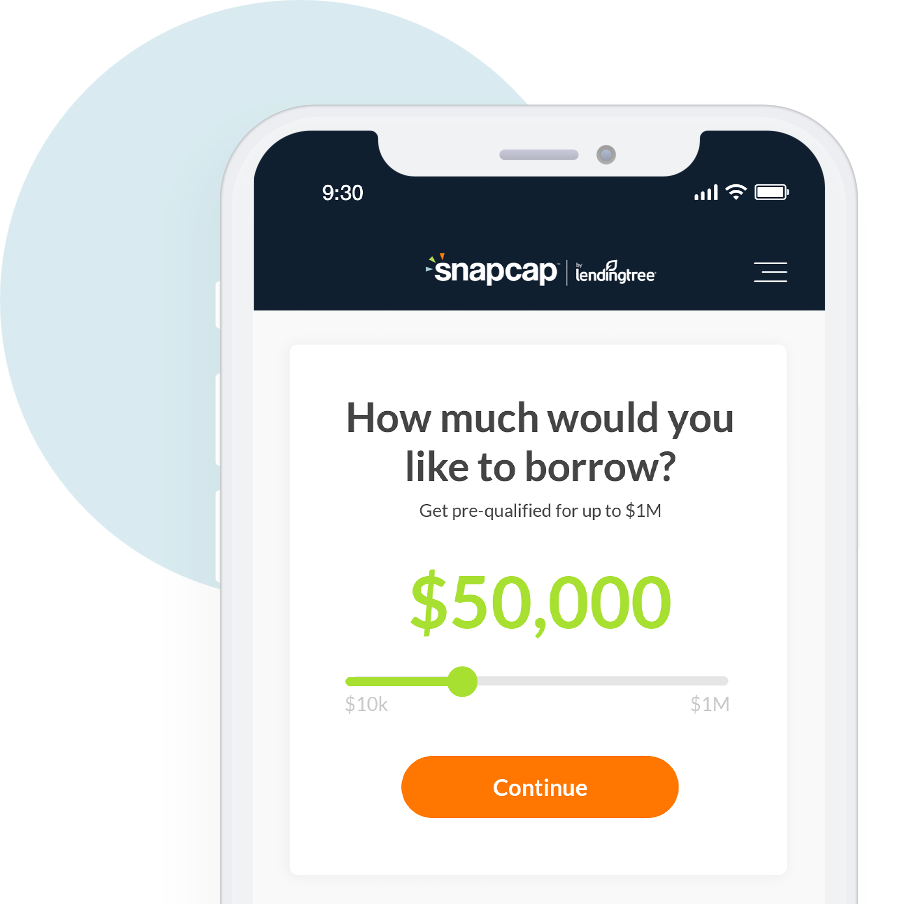

Get pre-qualified for up to $1M

How Does SnapCap Work?

We’re in the business of finding funds for your business, fast. Our application process uses our proprietary tech along with information from you to match you with the right funding solution. Unlike traditional funding, our process doesn’t require tedious stacks of paperwork to get started. In most cases, your request is reviewed within a few hours.

Qualifying for a Business Loan

Meeting minimum requirements does not guarantee funding, but we’ll work hard to get you the funding you need.

Why We're Different

Securing business funding can be a confusing and expensive process. We use the best financial technology to streamline that process. Our goal is to make a task that seems daunting and time consuming feel as easy as opening a new bank account. Requesting a quote and seeing rates is simple thanks to our technology, but slick tech isn’t the only thing that sets us apart. Our dedicated business account managers connect with business owners to build dependable relationships. You’re not in this alone, you’ve got SnapCap.

Business Funding Shouldn't Take Forever

Instead of a rigid 4 to 8 week review with a back and forth shuffle of information, we can get you access to loan terms in just a few hours. All it takes is some bank statements and some specifics about your business. We only collect the information we need to get accurate rates, nothing more.

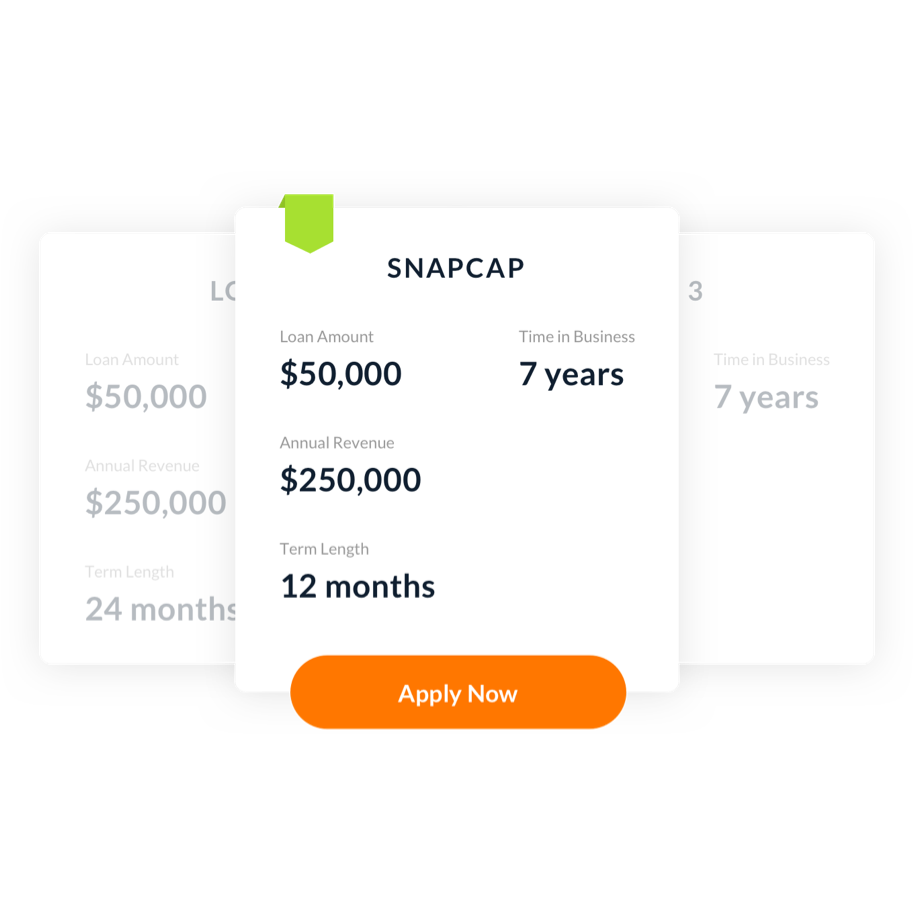

See It In Action

Check out a sample of business loans that we helped facilitate for real business owners. The amounts and terms listed are a broad representation of the loans we help fund daily.

SnapCap Case Studies

Meet some of the entrepreneurs who have used SnapCap loans and to support and grow their businesses.

-

Review from Emerge PR

“After experiencing SnapCap's timeless and profesionalism. I can easily see them leading this growing and necessary field.”Emerge PRPublic Relation - Working Capital & Marketing -

Review from The Wilson

“The SnapCap team was invaluable in addressing our business challenges and helping us move forward.”The WilsonRestaurant - Working Capital Loan -

Review from Jump on the School Bus

"With a business model focused on personalization abd rewarding good customers, SnapCap's doing lending right."Jump on the School BusTranspotation & Entertainment - Expansion & New Equipment

-

“After experiencing SnapCap's timeless and profesionalism. I can easily see them leading this growing and necessary field.”Emerge PRPublic Relation - Working Capital & Marketing

“After experiencing SnapCap's timeless and profesionalism. I can easily see them leading this growing and necessary field.”Emerge PRPublic Relation - Working Capital & Marketing -

“The SnapCap team was invaluable in addressing our business challenges and helping us move forward.”The WilsonRestaurant - Working Capital Loan

“The SnapCap team was invaluable in addressing our business challenges and helping us move forward.”The WilsonRestaurant - Working Capital Loan -

"With a business model focused on personalization abd rewarding good customers, SnapCap's doing lending right."Jump on the School BusTranspotation & Entertainment - Expansion & New Equipment

"With a business model focused on personalization abd rewarding good customers, SnapCap's doing lending right."Jump on the School BusTranspotation & Entertainment - Expansion & New Equipment

Reviews, panel 1

We Know Small Business

Over the last decade, we’ve helped secure nearly $1B in total funding, and we’ve learned a thing or two about business financing. In our experience, this process works best when you’ve got a partner. That’s us. SnapCap was created to support growing businesses by connecting them with credit when they need it — without the hassle. Let’s see what we can achieve together.